Forms & Disclosures

Estatements

CONSENT TO ELECTRONIC RECEIPT OF STATEMENTS AND OTHER COMMUNICATIONS

Please read this consent to electronic receipt of statements and other communications disclosure carefully. Keep a copy for your records.

Zing Credit Union is required by law to provide to you certain written periodic statements, notices, and other communications. Described below are the terms and conditions for receiving those communications electronically from Consumers, as required by the federal Electronic Signatures in Global and National Commerce Act (“ESIGN”)

Consent to Electronic Delivery of Statements and Other Communications

You are consenting to receive the following communications electronically: statements, disclosures, notices, agreements, changes to terms and conditions, fee schedules, records, documents, and other information we provide to you (collectively, the “Communications” or “Statements”). By consenting to enroll in electronic delivery of eStatements, you are agreeing to electronically receive all of the types of Communications that Zing Credit Union is able to provide in an electronic format. The types of documents available electronically are subject to change, and if additional Communications become available in an electronic format, you agree to receive those Communications electronically. Your consent remains in effect until you give us notice that you are withdrawing it. You also agree that Zing Credit Union does not need to provide you with an additional paper (non-electronic) copy of the Communications disclosed herein, unless specifically requested. Your consent covers all Communications, as described above, relating to any product offered by Zing Credit Union, either now or in the future. We may always, in our sole discretion, provide you with any Communication in writing, even if you have chosen to receive it electronically. Examples of Communications to be provided in electronic form include, but are not limited to, the following:

- Periodic Account Statements

- Monthly Credit Card Billing Statements

- Fee Schedules

- Privacy Notices

- Notices of Amendments to any of your Agreements with Zing Credit Union

- Disclosures and Notices for all Products Offered by Zing Credit Union

- Annual Tax Statements

Paper Delivery of Disclosures and Notices

You have the right to receive a paper copy of the Communications sent electronically. To receive a paper copy, please request it in one of the following ways: send an e-mail message with your name and mailing address to members@denvercommunity.coop, call us at 877.293.6328 and speak to the Representative, or write to Zing Credit Union, 1075 Acoma Street, Denver, CO 80204, with your name and mailing address. Be sure to state that you are requesting a copy of the statements, disclosures, notices, etc. You may have to pay a fee for the paper copy unless charging a fee is prohibited by applicable law. Please refer to the applicable agreement for any fee that may apply for paper copies.

Withdrawal of Electronic Acceptance of Disclosures and Notices

You can contact us in any of the ways described in the preceding paragraph to withdraw your consent to receive any future Communications electronically. You may also change your enrollment to paper statements by entering online banking, clicking statements, and choosing “Discontinue E-Statements”. Please be advised that there may be a fee for receiving paper statements.

Requirements to Access and Retain Information

In order to receive and retain electronic Communications, you must provide, at your own expense, an Internet connected device that is compatible with Zing Credit Union’s Online Banking products. Your device must meet the minimum requirements outlined below. You also confirm that your device will meet these specifications and requirements and will permit you to access and retain the disclosures and notices electronically each time you access and use online banking and other products. You must also have an active email address. It is your responsibility to provide and maintain current email contact information with us. You can update your email address for eStatement and Communications alerts by clicking “Change Email” while in the eStatement and Communications system.

To receive and retain electronic Communications from Zing Credit Union, you must have the following equipment and software:

- A personal computer or other device which is capable of accessing the Internet. Your access to this page verifies that your system/device meets these requirements.

- An Internet web browser such as Internet Explorer 8.0 or Firefox 5.0 which is capable of supporting 128-bit SSL encrypted communications or higher.

- You must have software which permits you to receive and access Portable Document Format or “PDF” files, such as Adobe Acrobat Reader®version4.0 or higher (available for downloading at http://get.adobe.com/reader. ). Your access to this page verifies that your system/device has the necessary software to permit you to receive and access PDF files.

To retain a copy of the electronic Communications from Zing Credit Union, your device must have the ability to download and store PDF files.

Truth in Savings

TRUTH IN SAVINGS DISCLOSURE

To view our savings rates, click the link below:

Except as specifically described, the following disclosures apply to all the accounts.

- Rate Information. The dividend rate, or interest rate, and annual percentage yield on your accounts are set forth on the reverse side. The annual percentage yield is a percentage rate that reflects the total amount of dividends/interest to be paid on an account based on the dividend/interest rate and frequency of compounding for an annual period. For Certificates of Deposit and IRA Certificates of Deposit, the interest rate and annual percentage yield are fixed and will be in effect for the term of the account. The annual percentage yield is based on an assumption that interest will remain on deposit until maturity. A withdrawal will reduce earnings.

- Nature of Dividends. Dividends are paid from current income and available earnings after providing for the required reserves. The dividend rates and annual percentage yields are the prospective rates and yields that the Credit Union anticipates paying for the applicable dividend period.

- Compounding and Crediting. Interest and dividends will be compounded and credited as set forth on the reverse side. The dividend/interest period for each account is also set forth on our Rate and Fee Schedule. The dividend/interest period begins on the first calendar day of the period and ends on the last calendar day of the period.

- Balance Information. The minimum balance required to open each account is set forth. Interest is calculated by the daily balance method which applies a daily periodic rate to the principal in the account each day.

- Accrual of Dividends. Dividends will begin to accrue on cash deposits on the business day you make the deposit to your account. Dividends will begin to accrue on noncash deposits (checks) on the business day you make the deposit to your account. If you close your account before accrued dividends are credited, accrued dividends will not be paid.

- Account Limitations. The account limitations for each account are set forth in our Membership and Account Agreement

- Your account will mature on the maturity date set forth on your account receipt or renewal notice.

- Early Withdrawal Penalties. A penalty may be imposed if you withdraw any of the certificate funds before the maturity date or the renewal date, if this is a renewal account.

- Amount of Penalty. For Certificates of Deposit and IRA Certificates of Deposit the amount of the early withdrawal penalty for your account is 90 days’ interest for a term of 12 months or less, and 180 days’ interest for a term over 12 months.

- How the Penalty Works. The penalty is calculated as a forfeiture of part or all of the interest that have been earned on the account. This penalty applies to earned interest and principal.

- Renewal Policy. Certificate of Deposit accounts will automatically renew for another term upon maturity. You have a grace period of seven days in which to change or withdraw the funds without being charged an early withdrawal penalty.

- Exception to Early Withdrawal Penalties. At our option, we may redeem the account before maturity without imposing an early withdrawal penalty under the following circumstances:

- When an account owner dies

- or is determined legally incompetent by a court

- or other body of competent jurisdiction.

- Nontransferable / Nonnegotiable. Your account is nontransferable and nonnegotiable. The funds in your account may not be pledged to secure any obligation of an owner except obligations with the Credit Union.

- FEES FOR OVERDRAWN ACCOUNTS. Fees may be imposed on each check, draft item, ATM card withdrawal, debit card withdrawal, debit card point of purchase, preauthorized automatic debit, telephone initiated withdrawal or any other electronic withdrawal or transfer transaction that is drawn on an insufficient available account balance. The entire balance in your account may not be available for withdrawal, transfer or payment of a check, draft or item. You may consult the Funds Availability Policy for information regarding the availability of funds in your account. Fees for overdrawing your account may be imposed for each overdraft, item or transaction. If we have approved an overdraft protection limit for your account, such fees may reduce your approval limit. Please refer to the Rate and Fee Schedule for current fee information.

Online Banking

DENVER COMMUNITY CREDIT UNION EBANKING AGREEMENT & DISCLOSURE

I. Introduction

This Disclosure and Agreement for accessing your Zing Credit Union accounts via eBanking is provided for your information. Please read it carefully as it pertains to your accounts and electronic services and it represents our mutual agreement with respect to transactions on Zing Credit Union’s eBanking. You should print out and keep this disclosure statement for future reference. For the purpose of this Agreement, the terms “we,” “us,” “our,” “Zing Credit Union,” and “credit union” refer to Zing Credit Union. “You” and “your” refers to Members and account owners who have received a password.

Entering your password when you sign in to Zing Credit Union’s eBanking confirms your agreement that you have read, understand and agree to abide by the terms and conditions of this Agreement and acknowledges your receipt and understanding of this disclosure connected with eBanking service. You agree to be bound by future changes in terms, which will be provided electronically. Additionally, you agree to be bound by future changes in terms relating to fees and consumer liability. You agree to review the disclosures that are provided each time you access Zing Credit Union’s eBanking.

Furthermore, you agree that your use of eBanking and your obligations under this Agreement means that you are consenting to the electronic delivery to you by Zing Credit Union of all disclosures, notices, receipts, statements, and other information required by law. In making this election, you retain the right to notify Zing Credit Union of your decision to rescind this election and to begin receiving disclosures, notices, receipts, statements, in paper form. If you choose to rescind this election, you agree to provide us notification no less than five (5) business days prior to the date that the periodic statement would normally be made available to you. Further, you agree that you will provide this notification by e-mail as provided herein or by calling Zing Credit Union at (303) 573-1170 or (877) 293-6328. Withdrawal of this consent may result in a change of terms to your checking account with Zing Credit Union. Please contact Zing Credit Union at the above telephone number to identify how this electronic statement election may affect your account. If, during the period of time that you have elected to receive statements electronically, and you wish to receive a paper copy of any individual statement, you may do so by contacting Zing Credit Union via e-mail or telephone as provided herein. You agree to pay the fee according to Zing Credit Union’s fee schedule for a statement printout.

We may change terms or amend this Agreement from time to time without notice or as otherwise provided by law. eBanking services can be used to access certain Zing Credit Union accounts. Each of your accounts at Zing Credit Union is also governed by the applicable disclosure statement (your Membership and Account Agreement, prior receipts of which you acknowledge).

This Agreement will be governed by and interpreted in accordance with federal law and regulation, and to the extent that there is no applicable federal law or regulation, by the laws of the State of Colorado. To the extent permitted by applicable law, you agree that any legal action regarding this Agreement shall be brought in the county in which the credit union is located.

II. Keeping Your Account Confidential

A. Password

For your protection, we recommend that you frequently change your password used to access eBanking and Voice Banking. You agree to hold your password in strict confidence and you will notify us immediately if it is lost or stolen. As a precaution, it is recommended that you memorize your password and do not write it down. You are responsible for keeping your password and account information confidential.

B. Personal Information Protection

In addition to protecting your password and account information, you should also protect your personal identification information, such as your driver’s license, social security number, etc. This information, alone or together with information on your account, may allow unauthorized access to your account. It is your responsibility to protect your personal information with the same level of care that you protect your account information.

C. Examine Your Statement

You must promptly review your statement upon receipt. Please review your Membership & Account Agreement for full details.

III. How to Contact Us

Contact Zing Credit Union in event of unauthorized transfer. If you believe your password has been lost or stolen or unauthorized access occurred on your account, or that someone has transferred or may transfer money from your account by accessing your account without your permission, or if for any reason you wish to contact us about your account, call or write us as follows:

A. Business Days

Our lobby is open for business Monday 9:00am – 6:00pm, Tuesday through Friday 9:00am – 5:00pm, and Saturday 9:00am – 1:00pm. Our downtown drive through facility located at 1028 Acoma Street in Denver is open Monday through Friday from 7:00 a.m. to 6:00 p.m. and Saturday from 9:00 a.m. to 1:00 p.m. You can contact us by visiting our Downtown Office located at 1075 Acoma Street in Denver during normal business hours or by telephoning (303) 573-1170 or 1-(877) 293-6328. Our Call Center Representatives are available 8:00 a.m. to 6:00 p.m. MST Monday through Friday, excluding holidays, and Saturday from 9:00am – 1:00pm. Calling us is the best way to report any problems or to get questions answered. If you cannot call us or come in person, you can write to us at: Zing CU, 1075 Acoma Street, Denver, CO 80204-4092.

B. e-Mail

Sending e-mail through our “Contact Us” on Zing Credit Union’s web site is one way to communicate with us. We have provided a contact form on our website for you to ask questions or give comments regarding our website or eBanking service. Please note that e-mail is not initiated from a secure session. To ensure the security of your account information, you cannot use e-mail to initiate transactions on your account(s). In addition, we recommend that you contact us by telephone to report any problems or ask questions about your account. Contacting us by e-mail does not protect your rights for unauthorized access. However, with eBanking, there is a secure messaging system once you are signed into eBanking. Use this as you would like, but contacting us by secure e-mail does not protect your rights for unauthorized access.

IV. eBanking Disclosure

A. Account Access

Zing Credit Union’s eBanking is an Internet account access service. You may access your account(s) by computer using your account number, password, and direct connection to the Internet. By using eBanking, you can: make inquiries, check account balances, transfer funds between your accounts, access your current or past monthly statements, and download account history into personal financial management software.

Services available may be added or canceled at any time. We shall update this Agreement to notify you of the existence of these new services. By using these services when they become available, you agree to be bound by the rules contained in this Agreement.

You can use eBanking seven days a week, 24 hours a day. However, from time to time, some or all of eBanking services may not be available due to normal system maintenance.

B. Transfer Terms and Limitations

In compliance with Federal Regulation D, Zing Credit Union is required to limit transfers from share savings, money market, club accounts, and all other non-transactional accounts to no more than six (6) transfers per calendar month, if they are to another of your Zing Credit Union accounts or a third party by means of a preauthorized, automatic, share draft, telephonic (Voice Banking or oral) or Internet instruction.

C. Disclosure of Information to Third Parties

We will not disclose information to third parties about your account or the transactions you make, unless:

(1) Where it is necessary for completing transfers.

(2) In order to verify the existence and condition of your account for a third party, such as a credit bureau or merchant.

(3) In order to comply with a government agency or court orders.

(4) If you give us written permission.

D. Consumer Liability

By accessing Zing Credit Union’s eBanking, you agree that it is your responsibility to safeguard your password, in order to prevent unauthorized transactions and/or account access. You assume all responsibility for any losses that occur on your account due to negligence i.e. failing to protect your password from unauthorized use. You also agree that Zing Credit Union may revoke Internet account access if unauthorized account access and/or transactions occur as the apparent result of your negligence in safeguarding the password, for any violation of the terms of use, for use of the system for illegal activities or for any other use of the system that, in the opinion of Zing Credit Union, presents an unreasonable risk of damage or loss to Zing Credit Union, its members or third parties.

Notify Zing Credit Union immediately if you believe your password has been lost or stolen, or your account has been accessed without your authorization. The best way to minimize your possible loss is to telephone, though you may advise us in person or in writing. You could lose all the money in your account (plus your maximum overdraft line of credit). If you tell us within two (2) business days after you learn of unauthorized access, you can lose no more than $50 if someone used your password without your permission.

If you do not tell us within two (2) business days after you learn of the unauthorized access, and we can prove we could have stopped someone from using your account without your permission if you had told us during that two (2) business day period, you could lose as much as $500.

If your statement shows any electronic fund transfer that you did not make or authorize, advise Zing Credit Union immediately of the unauthorized access. If you do not tell us within sixty (60) days after the first statement that reflected the unauthorized transfer was transmitted to you, you may not get back any money you lost after the sixty (60) days, provided we can prove that we could have stopped someone from taking the money if you had told us within that sixty (60) day period.

Zing Credit Union in its sole discretion may determine to extend the above time periods for good cause shown.

E. Our Liability for Failure to Complete Transfers

If Zing Credit Union does not complete a transfer to or from your account on time or in the correct amount according to this disclosure statement with you, we will be liable for your losses or damages not to exceed the amount of the transaction, except as otherwise provided by law. However, there are some exceptions. We will NOT be liable, if:

(1) Through no fault of ours, you do not have enough money in your account to make the transfer.

(2) You have an overdraft protection line of credit and the transfer would go over the credit limit.

(3) The terminal or computer was malfunctioning in a manner which you knew, or reasonably should have known, would adversely affect the completion of your transaction.

(4) Circumstances beyond our control (such as fire or flood) prevent the transfer, despite reasonable precautions that we have taken.

F. In Case of Errors or Questions About Your Electronic Transfers

Call or write us at: Zing Credit Union, 1075 Acoma Street, Denver, Colorado 80204, (303) 573-1170 or toll free 1 (877) 293-6328, as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt.

(1) Tell us your name and account number (if any).

(2) Describe the error or the transaction you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error. If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days.

We will tell you the results of our investigation within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, we will credit your account within 10 business days for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account.

If we decide that there was no error, we will send you a written explanation within 3 business days after we finish our investigation. You may ask for copies of the documents that we used in our investigation.

G. Lost or Stolen Card or (PIN) Personal Identification Number

If you believe your Visa® credit card, Visa® debit card, ATM card, or PIN code has been lost or stolen or that someone has transferred or may transfer money from your account without your permission, telephone us at once at 303-573-1170.

H. Miscellaneous Fees and Charges

Access to Zing Credit Union’s eBanking is free. Regular charges and fees do apply on certain transactions such as requesting copies of cleared checks, ordering checks, bill payment, etc. Zing Credit Union reserves the right to charge for Internet account access services. You will be given at least thirty (30) days advance notice before Zing Credit Union implements any charges or fees for any Internet account access related services.

I. Unlawful Internet Gambling Enforcement Act

In accordance with the requirements of the Unlawful Internet Gambling Enforcement Act of 2006 and Regulation GG, if you are a commercial member of Zing Credit Union, restricted transactions are prohibited from being processed through your account or relationship with our institution. Restricted transactions are transactions in which a person or business entity accepts credit, funds, instruments or other proceeds from another person or business entity in connection with unlawful Internet gambling.

By maintaining an account with Zing Credit Union, you certify that you do not engage in Internet gambling and you agree to notify us if your account is ever used for Internet gambling of any kind, even if you believe the activity to be legal. If you do not, we may terminate your access to eBanking, various payment methods, or close your account.

V. Other General Terms

Other Agreements — In addition to this Agreement, you agree to be bound by and will comply with all terms and conditions applicable to your account with Zing Credit Union, as described in your Membership & Account Agreement, prior receipt of which you acknowledge.

Severability — In the event that any portion of this Agreement is held by a court to be invalid or unenforceable for any reason, the remainder of this Agreement shall not be invalid or unenforceable and will continue in full force and effect. All headings are intended for reference only and are not to be construed as part of the Agreement.

Right to Terminate Agreement — You may request termination of this service in writing. We may terminate your right to use eBanking or to make electronic fund transfers or cancel this agreement at any time.

Our Liability — Except as specifically provided in this Agreement or where the law requires a different standard, you agree that neither we nor the service providers shall be responsible for any loss, property damage or bodily injury, whether caused by the equipment, software, Zing Credit Union, or by internet browser providers such as Netscape (Netscape Navigator browser) and Microsoft (Microsoft Explorer browser), OR by Internet access providers OR by online service providers OR by an agent or subcontractor of any of the foregoing. Nor shall we or the service providers be responsible for any direct, indirect, special, or consequential economic or other damages arising in any way out of the installation, download, use, or maintenance of the equipment, software, eBanking services, or Internet browser or access software. In this regard, although we have taken measures to provide security for communications from you to us via eBanking, and may have referred to such communication as “secured,” we cannot and do not provide any warranty or guarantee.

Digital Wallet

DIGITAL WALLET TERMS AND CONDITIONS

Terms for Adding Your Zing Credit Union cards to a Digital Wallet

These Terms for Adding your Zing Credit Union (“Zing”) Card to a Digital Wallet (the “Terms”) apply when you choose to add a Zing debit card, credit card or stored value (“Zing Card”) to a Digital Wallet (“Wallet”). In these Terms, “you” and “your” refer to the cardholder of the Zing Card, and “we,” “us,” “our,” and “Zing” refer to the issuer of your Zing Card, which is Zing Credit Union.

- Adding your Zing Card. You can add an eligible Zing Card to the Wallet by following the instructions of the Wallet provider. Only Zing Cards that we indicate are eligible can be added to the Wallet. If your Zing Card or underlying account is not in good standing, that Zing Card will not be eligible to enroll in the Wallet. When you add a Zing Card to the Wallet, the Wallet allows you to use the Zing Card to enter into transaction where the Wallet is accepted. The Wallet may not be accepted at all places where your Zing Card is accepted.

- Your Zing Card Terms Do Not Change. The terms and account agreement that govern your Zing Card do not change when you add your Zing Card to the Wallet. The Wallet simply provides another way for you to make purchases with the Zing Card. Any applicable interest, fees, and charges that apply to your Zing Card will also apply when you use the Wallet to access your Zing Card. Zing does not charge you any additional fees for adding your Zing Card to the Wallet or using your Zing Card in the Wallet. The Wallet provider and other third parties such as wireless companies or data service providers may charge you fees.

- Zing is Not Responsible for the Wallet. Zing is not the provider of the Wallet, and we are not responsible for providing the Wallet service to you. We are only responsible for supplying information securely to the Wallet provider to allow usage of the Zing Card in the Wallet. We are not responsible for any failure of the Wallet or the inability to use the Wallet for any transaction. We are not responsible for the performance or non-performance of the Wallet provider or any other third parties regarding any agreement you enter into with the Wallet provider or associated third-party relationships that may impact your use of the Wallet.

- Contacting You Electronically and by Email. You consent to receive electronic communications and disclosures from us in connection with your Zing Card and the Wallet. You agree that we can contact you by email at any email address you provide to us in connection with any Zing account. It may include contact from companies working on our behalf to service your accounts. You agree to update your contact information with us when it changes.

- Removing Your Zing Card from the Wallet. You should contact the Wallet provider on how to remove a Zing Card from the Wallet. We can also block a Zing Card in the Wallet from purchases at any time.

- Governing Law and Disputes. These Terms are governed by federal law and, to the extent that state law applies, the laws of the state that apply to the agreement under which your Zing Card is covered. Disputes arising out of or relating to these Terms will be subject to any dispute resolution procedures in your Zing Card agreement.

- Ending or Changing these Terms; Assignments. We can terminate these Terms at any time. We can also change these Terms, or add or delete any items in these Terms, at any time. We will provide notice if required by law. We can also assign these Terms. You cannot change these terms, but you can terminate these Terms at any time by removing all Zing Cards from the Wallet. You may not assign these Terms.

- Privacy. Your privacy and the security of your information are important to us. U.S. Consumer Privacy Notice applies to your use of your Zing Card in the Wallet. You agree that we may share your information with the Wallet provider, a payment network, and others in order to provide the services you have requested, to make information available to you about your Zing Card transactions, and to improve our ability to offer these services. This information helps us to add our Zing Card to the Wallet and to maintain the Wallet. We do not control the privacy and security of your information that may be held by the Wallet provider and that is governed by the privacy policy given to you by the Wallet provider.

- Notices. We can provide notices to you concerning these Terms and your use of a Zing Card in the Wallet by posting the material on our website, through electronic notice given to any electronic mailbox we maintain for you or to any other email address or telephone number you provide to us, or by contacting you at the current address we have on file for you. You may contact us at: (303) 573-1170.

- Questions. If you have any questions, disputes, or complaints about the Wallet, contact the Wallet provider using the information given to you by the provider. If your question, dispute, or complaint is about your Zing Card, then contact us at: (303) 573-1170.

Funds Availability

FUNDS AVAILABILITY DISCLOSURE – REGULATION CC

This disclosure describes your ability to withdraw funds at Zing Credit Union. It only applies to the availability of funds in the transaction accounts. The Credit Union reserves the right to delay the availability of funds deposited to accounts that are not transaction accounts for periods longer than those disclosed in this disclosure.

1. General Policy. Our policy is to make funds from your cash and check deposits available to you on the same business day that we receive your deposit. Electronic deposits will be available on the day we receive the deposit. Once the funds are available, you can withdraw them in cash, and we will use them to pay checks that you have written. Please remember that even after we have made those funds available to you, and you have withdrawn the funds, you are still responsible for checks you deposit that are returned to us unpaid and for any other problems involving your deposit. For determining the availability of your deposits, every day is a business day except Saturdays, Sundays and federal holidays. If you make a deposit before closing on a business day that we are open, we will consider that day to be the day of your deposit. However, if you make a deposit after closing or on a day we are not open, we will consider that the deposit was made on the next business day we are open.

2. Reservation of Right to Hold. In some cases, we will not make all of the funds that you deposit by check available to you on the same business day that we receive your deposit. Depending on the type of check that you deposit, funds may not be available until the 2nd business day after the day of your deposit. However, the first $225 of your deposit will be available on the first business day after the day of your deposit. If we are not going to make all of the funds from your deposit available on the same business day, we will notify you at the time you make the deposit. We will also tell you when the funds will be available. If your deposit is not made directly to one of our employees, or if we decide to take further action after you have left the premises, we will mail you the notice by the next business day after we receive your deposit. If you will need the funds from a deposit right away you should ask us when the funds will be available.

3. Holds on Other Funds. If we cash a check for you that are drawn on another financial institution, we may withhold the availability of a corresponding amount of funds that are already in your account. Those funds will be available at the time funds from the check we cashed would have been available if you had deposited it. If we accept for deposit a check that is drawn on another financial institution, we may make funds from the deposit available for withdrawal immediately but delay your availability to withdraw a corresponding amount of funds that you have on deposit in another account with us. The funds in the other account would then not be available for withdrawal until the time periods that are described elsewhere in this disclosure for the type of check that you deposited.

4. Longer Hold Delays May Apply. We may delay your ability to withdraw funds deposited by check into your account an additional number of days for these reasons:

1. We believe a check you deposit will not be paid

2. You deposit checks totaling more than $5,525 on anyone day

3. You deposit a check that has been returned unpaid

4. You have overdrawn your account repeatedly in the last six (6) months, or

5. There is an emergency, such as failure of communications or computer equipment.

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when the funds will be available. They will generally be available no later than the 7th business day after the day of your deposit.

5. Special Rules for New Accounts. If you are a new member, the following rules will apply for the first thirty (30) days your account is open. Funds from cash, wire transfers, electronic direct deposits will have the same day availability. The first $5,525 of a day’s total deposits of cashier’s, certified, travelers, federal, state and local government, and City and County of Denver payroll checks will have next day availability. The checks must be payable to you. Funds from all other check deposits will be available on the 9th business day after the day of your deposit.

6. Deposits at Nonproprietary ATMs. Funds from any deposits (cash or checks) made at an automatic teller-machine (ATMs) we do not own or operate will not be available until the 5th business day after the day of your deposit.

7. Dividend Payment Policy. Dividends accrue on the daily collected balance and are paid on the last day of each month.

8. Endorsement Procedure. The payee endorsement area is the top 1½ inches of the check. All other areas must be avoided. The Credit Union has right to refuse any check for deposit.

ACH Dispute Form

Use this form to file a dispute about ACH transactions. Examples of disputable items include, but are not limited to unauthorized ACH transactions, ACH transactions processed after permission is revoked, ACH transactions posted prior to authorization date, and ACH transactions processed for a different amount than authorized.

ATM Dispute Form

Use this form to file a dispute about an ATM transaction. Examples of disputable items include withdrawal overage, withdrawal shortages, or issues with an ATM deposit.

If you prefer to give us a call, our local contact center is happy to help at 303-573-1170.

Cardholder Dispute Form

Use this form to file a dispute about a transaction made with a debit, credit or Clear Card. Examples of disputable items include being billed the wrong amount, duplicate charges, being charged for a cancelled transaction, non-receipt of merchandise or service, merchandise or service was not as described, or credit was not processed.

If you prefer to give us a call, our local contact center is happy to help at 303-573-1170.

Fraud Dispute Form

Use this form to file a dispute about fraudulent activity on your account.

If you prefer to give us a call, our local contact center is happy to help at 303-573-1170.

Mobile Check Deposit Services Agreement

MOBILE CHECK DEPOSIT SERVICES AGREEMENT

This Remote Deposit Capture Services Agreement (“Agreement”) is a contract between you and Zing Credit Union which establishes terms and conditions for the use of Zing’s remote deposit capture services. In addition to this Agreement, the use of Zing’s remote deposit capture services is governed by your Membership and Account Agreement, eBanking Agreement and Disclosure, and any other agreement between you and Zing.

1) Definitions

In this Agreement, the following terms have the following meanings:

a) “You” and “your” means the Zing member who enrolls in or uses the internet banking services.

b) “We,” “us,” and “our” mean Zing Credit Union (“Zing”).

c) “Remote deposit capture service” or “Service” mean the use of software and/or hardware provided by Zing to capture images of eligible items and deposit them to eligible accounts.

d) “Accounts” mean the accounts on which you are the owner or co-owner at Zing, and for which remote deposit capture services are available.

e) “Business days” are Monday through Friday, excluding Federal bank holidays.

2) Eligible Accounts

In order to use the Service, you must be a Zing member or joint owner of a Zing account in good standing, and at least eighteen (18) years of age. Additionally, we may establish other criteria for determining the eligibility of accounts (for example, the length of time the account has been open) at our sole discretion. You or we may terminate the Service on any account at any time and for any reason.

3) Eligible Items

Only checks may be deposited through the Service. By depositing an item through the Service, you agree and warrant that the following is true:

a) The item is payable to the person or persons who own the account into which it is being deposited;

b) The item has been properly endorsed under your Deposit Account Contract and applicable law;

c) The item is not drawn on a financial institution located outside of the United States;

d) The item is payable in United States currency;

e) The item is not dated in the future or more than six (6) months prior to the date of deposit;

f) The item has not previously been presented for payment at Zing or to any other party;

g) The item does not contain any alterations of which you know;

h) You do not know or believe the item to be fraudulent or unauthorized.

We may review or verify any item deposited through the Service, and we may reject an item for deposit for any reason without liability. If we reject an item through the remote deposit capture service, we may accept it through another channel (for example, at a Zing branch).

4) Image Quality

We may determine, at our sole discretion, whether an image of an item submitted through the Service is of sufficient quality for acceptance and presentment.

5) Errors

You agree that the provisions of your Membership and Account Agreement regarding your responsibilities to notify us of errors apply to items deposited through the Service. You agree that the deposit of an item through the Service is not an “Electronic Funds Transfer” under the federal Consumer Financial Protection Bureau’s Regulation E.

6) Availability of Funds

Subject to the other provisions of this Agreement, funds deposited through the Service will be available on the second (2nd) business day after the day of your deposit. The first five hundred dollars ($500) from such deposits will be available on the first (1st) business day after your deposit. If you make a deposit before 6:00 p.m. Mountain Time on a business day that we are open, we will consider that day to be the day of your deposit. However, if you make a deposit after 6:00 p.m. Mountain Time or on a day we are not open, we will consider that the deposit was made on the next business day we are open. We may make some or all of the funds deposited through the Service available sooner than the times described in this Paragraph, at our sole discretion. You agree that items deposited through the Service are not subject to the funds availability of the Federal Reserve Board Regulation CC, and that we may delay the availability of funds deposited through the service if we determine that the item is not eligible as described in Paragraph 3 of this Agreement or that the item is over any deposit limit we may establish, or if we believe for any reason that the item may not be paid.

7) Destruction of Original Items

After you use the Service to deposit an item, you agree not to deposit the same item anywhere else or through any other channel. You agree to retain the item for sixty (60) days, or longer if we request it, and then destroy the item or otherwise make it incapable of further deposit or presentment. You agree to be liable for the failure to destroy items as described in this Agreement, or if an item is deposited through the Service and the same item is later presented or deposited again.

8) Deposit Limits

We may establish limits on the total number of checks or total amount of checks deposited through the Service. We may establish or change such limits at any time and without notice to you.

9) Indemnity

You agree to be solely liable for the use or misuse of the Service, and you agree to indemnify, defend and hold us and any third-party provider of software or services harmless from any legal action or claim asserted against us and/or third-party providers by any other party relating to your use of the Service and any claims, liabilities, damages, costs and expenses (including reasonable attorney fees) incurred by us and/or its third-party provider as a result of your use or misuse of the Service.

10) Limitations on Service

You agree not to hold us liable for interruptions in the availability or functionality of the service, which may occur without notice to you for technical or other reasons.

11) Amendment

We may add to, change, or delete the terms of this Agreement by providing notice to you. We may also add to, change, or delete some functionalities or features of the Service at any time without notice. If you do not consent to a modification of this Agreement or the Service, you may terminate and discontinue your use of the Service at any time by notifying us.

12) No Waiver

We will not be deemed to have waived any of our rights or remedies under this Agreement unless such waiver is in writing and signed by us. No delay or omission on our part in exercising any rights or remedies will operate as a waiver of such rights or remedies or any other rights or remedies. A waiver on any one occasion will not be construed as a bar or waiver of any rights or remedies on future occasions.

13) Severability

The invalidity or unenforceability of any provision of this Agreement will in no way affect the validity or enforceability of the remainder of this Agreement or any of its provisions.

14) Applicable Law

This Agreement will be governed by and construed in accordance with Colorado law to the extent not preempted by federal law. The parties consent to jurisdiction and venue for resolution of disputes in Denver County, Colorado.

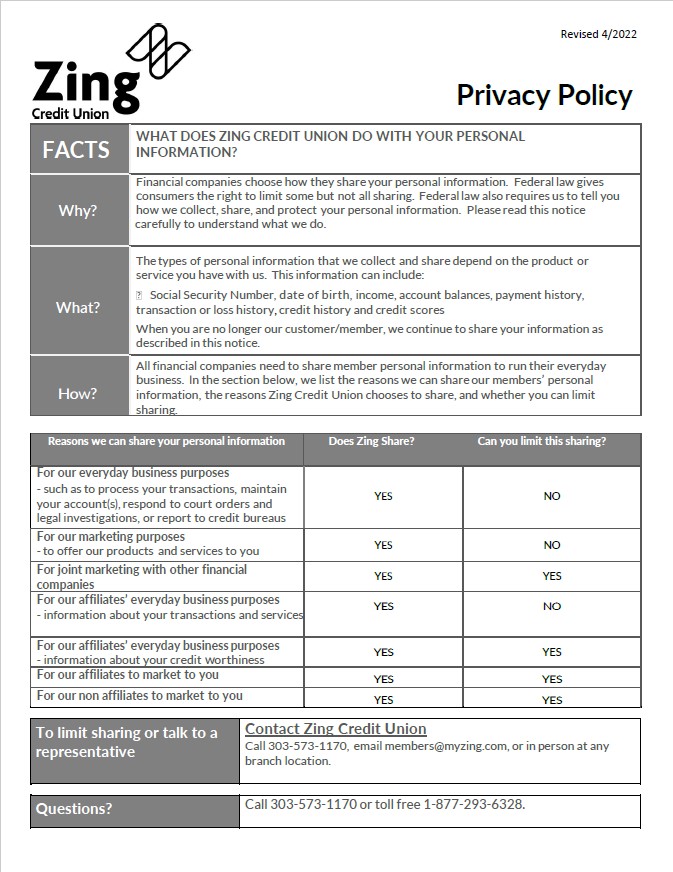

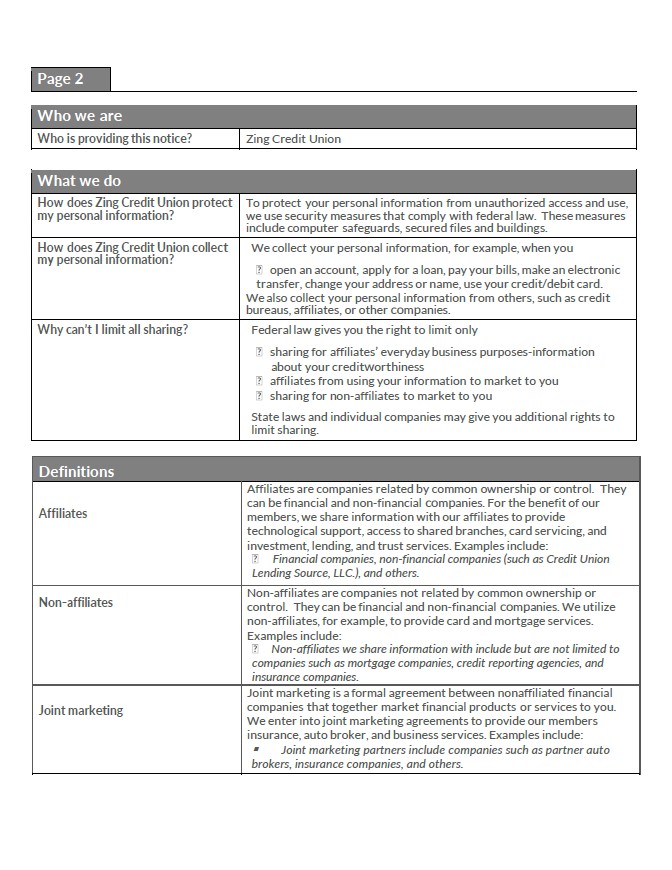

Privacy Policy

Third Party Site Agreement

THIRD PARTY SITE AGREEMENT

While on Zing Credit Union’s website, www.myzing.com, you may click on a link that takes you to a third party website.

By clicking on a third party link, you are leaving Zing Credit Union’s website. Zing does not control third party sites and is not responsible for the content, products, or services available on the linked site. The credit union does not represent the third party or the member, if the two enter a transaction. The privacy and security policies of this linked site may differ from our own.

Truth In Savings Disclosure

TRUTH IN SAVINGS DISCLOSURE

Except as specifically described, the following disclosures apply to all the accounts.

- Rate Information. The dividend rate, or interest rate, and annual percentage yield on your accounts are set forth on the reverse side. The annual percentage yield is a percentage rate that reflects the total amount of dividends/interest to be paid on an account based on the dividend/interest rate and frequency of compounding for an annual period. For Certificates of Deposit and IRA Certificates of Deposit, the interest rate and annual percentage yield are fixed and will be in effect for the term of the account. The annual percentage yield is based on an assumption that interest will remain on deposit until maturity. A withdrawal will reduce earnings.

- Nature of Dividends. Dividends are paid from current income and available earnings after providing for the required reserves. The dividend rates and annual percentage yields are the prospective rates and yields that the Credit Union anticipates paying for the applicable dividend period.

- Compounding and Crediting. Interest and dividends will be compounded and credited as set forth on the reverse side. The dividend/interest period for each account is also set forth on our Rate and Fee Schedule. The dividend/interest period begins on the first calendar day of the period and ends on the last calendar day of the period.

- Balance Information. The minimum balance required to open each account is set forth. Interest is calculated by the daily balance method which applies a daily periodic rate to the principal in the account each day.

- Accrual of Dividends. Dividends will begin to accrue on cash deposits on the business day you make the deposit to your account. Dividends will begin to accrue on noncash deposits (checks) on the business day you make the deposit to your account. If you close your account before accrued dividends are credited, accrued dividends will not be paid.

- Account Limitations. The account limitations for each account are set forth in our Membership and Account Agreement

- Your account will mature on the maturity date set forth on your account receipt or renewal notice.

- Early Withdrawal Penalties. A penalty may be imposed if you withdraw any of the certificate funds before the maturity date or the renewal date, if this is a renewal account.

- Amount of Penalty. For Certificates of Deposit and IRA Certificates of Deposit the amount of the early withdrawal penalty for your account is 90 days’ interest for a term of 12 months or less, and 180 days’ interest for a term over 12 months.

- How the Penalty Works. The penalty is calculated as a forfeiture of part or all of the interest that have been earned on the account. This penalty applies to earned interest and principal.

- Renewal Policy. Certificate of Deposit accounts will automatically renew for another term upon maturity. You have a grace period of seven days in which to change or withdraw the funds without being charged an early withdrawal penalty.

- Exception to Early Withdrawal Penalties. At our option, we may redeem the account before maturity without imposing an early withdrawal penalty under the following circumstances:

- When an account owner dies

- or is determined legally incompetent by a court

- or other body of competent jurisdiction.

- Nontransferable / Nonnegotiable. Your account is nontransferable and nonnegotiable. The funds in your account may not be pledged to secure any obligation of an owner except obligations with the Credit Union.

- FEES FOR OVERDRAWN ACCOUNTS. Fees may be imposed on each check, draft item, ATM card withdrawal, debit card withdrawal, debit card point of purchase, preauthorized automatic debit, telephone initiated withdrawal or any other electronic withdrawal or transfer transaction that is drawn on an insufficient available account balance. The entire balance in your account may not be available for withdrawal, transfer or payment of a check, draft or item. You may consult the Funds Availability Policy for information regarding the availability of funds in your account. Fees for overdrawing your account may be imposed for each overdraft, item or transaction. If we have approved an overdraft protection limit for your account, such fees may reduce your approval limit. Please refer to the Rate and Fee Schedule for current fee information.

Checking Comparison Chart

Compare Checking Accounts

| Preferred Checking | Clear Card | Second Chance Checking | |

| Minimum Opening Balance | Suggested opening amount- $25 | $0 | Suggested opening amount- $25 |

| ID Safe Choice Charge Possible | Yes | No | Yes |

| Direct Deposit | Accepted and encouraged | Accepted and encouraged | Accepted and encouraged |

| Dividends Paid | No | No | No |

| Privilege Pay | Available after 90 days | No | No |

| Overdraft LOC | Available immediately, with approved credit | No | Available immediately, with approved credit |

| ATM/Debit Card | Instant Issue | Instant Issue | Instant Issue |

| Shared Branching | Available | Available | Available |

| Free Bill Payer | Available | Available | Available |

| Mile High APY | Yes | N/A | Yes |

| 5 Buck Club | Yes | No | Yes |

Social Media

SOCIAL MEDIA POLICY

Zing Credit Union’s social media channels include Facebook, Twitter, Youtube, LinkedIn, and Instagram. Social media is intended to provide a place for fans of Zing Credit Union to discuss Zing Credit Union activities, events, products, and promotions. All comments, visuals, videos and other type of material posted by fans on Zing’s social media sites (“User Content”) do not necessarily reflect the opinions or ideals of Zing Credit Union, its employees or affiliates. Zing (a) does not represent or warrant the accuracy of any statement or product claims made here, (b) is not responsible for any User Content on this site, and (c) does not endorse any opinions expressed on any Zing social media page.

Zing expects all users to comply with the social media networks’ proprietary Terms of Use. Zing does not monitor every posting of User Content on Zing social pages. Zing expects, however, that users will not post any materials that fall into any of the following categories and may have removed any materials that: